Calls for direct compensation, debt relief, gain traction

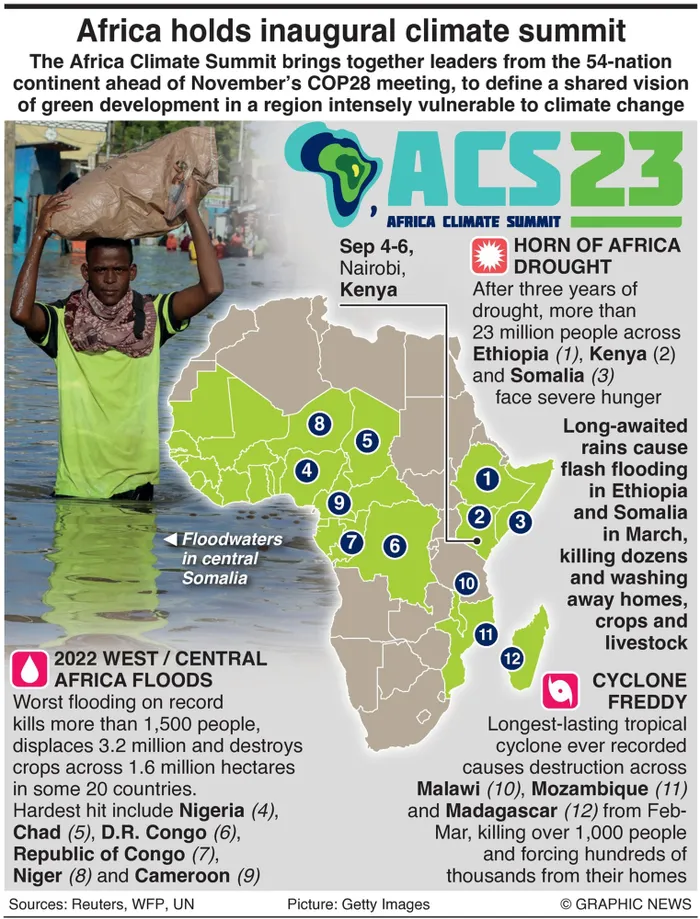

Graphic: Graphic News/September 4, 2023 – The Africa Climate Summit brought together leaders from 54 nations on the continent to define a shared vision of green development in a region intensely vulnerable to climate change. Scientists say climate change is causing more intense and more frequent extreme weather events.

Picture: Monicah Mwangi/REUTERS/Taken September 6, 2023 – Kenya's President William Ruto, flanked by African leaders, addresses the media after the close of the Africa Climate Summit (ACS) 2023 at the Kenyatta International Convention Centre (KICC) in Nairobi, Kenya, September 6, 2023.

By Dominic Naidoo

The Africa Carbon Markets Initiative (ACMI) saw a surge in investments aimed at boosting carbon credit production at Africa’s first climate summit in Nairobi. Investors, including the United Arab Emirates (UAE), Germany, and the UK, committed hundreds of millions of dollars towards this ambitious initiative. The UAE made one of the most significant commitments, with its investors pledging to purchase $450m (R8.62billion) worth of carbon credits from ACMI.

This initiative, launched at Egypt’s COP27 summit last year, aims to increase Africa’s carbon credit production a staggering 19-fold by 2030. Kenyan President William Ruto, who inaugurated the summit, stressed the importance of green growth, not only as a climate imperative but also as a substantial economic opportunity for Africa and the world. He expressed hope in capitalising on these opportunities.

Financing Instruments

African leaders are advocating for market-based financing instruments, such as carbon credits, as a means to curb emissions and mobilise climate funding. Carbon credits are generated by projects that reduce emissions, such as reforestation or transitioning to cleaner energy sources. Companies can purchase these credits to offset their own emissions, effectively contributing to climate targets.

The organisers of the three-day summit aim to portray Africa as an attractive destination for climate investments, shifting the narrative from victimhood to opportunity. Market-based financing mechanisms, including carbon credits, are seen as critical tools to accelerate climate finance in Africa.

Challenges and funding

Despite the potential of carbon credits, investors have been hesitant due to perceived risks associated with Africa. Africa’s climate financing has been slow to materialise, with the continent receiving only about 12 percent of the funding required to address climate impacts, as reported by the non-profit Climate Policy Initiative. Kevin Kariuki, a vice president at the African Development Bank, acknowledged the importance of the investments but emphasised the need for more substantial commitments. He revealed that African states would push for the expansion of special drawing rights at the International Monetary Fund during COP28, potentially unlocking $500bn (R9.57 trillion) in climate finance.

Private sector potential

The private sector remains largely untapped in the climate finance arena, a point highlighted by Patricia Scotland, Secretary-General of the Commonwealth of 56 countries. She emphasised Africa’s untapped potential in renewable energy sources such as thermal, solar, wind, and hydro. More than 20 presidents and heads of government are expected to participate in the summit, aiming to outline Africa’s stance before the UN climate conference and COP28.

Additional commitments

The UAE’s commitment to climate financing in Africa has positioned it as a leader in this arena. The UAE Carbon Alliance, a coalition of private sector entities, announced the $450m commitment. Climate Asset Management, a joint venture of HSBC Asset Management and Pollination, pledged $200m (R3.83bn) for ACMI credits. The UK announced that it would reveal £49m (R1.17bn) worth of UK-backed projects during the summit, while Germany unveiled a €60m (R1.23bn) debt swap with Kenya to allocate funds for green projects.

Despite these substantial commitments, some African campaigners remain critical of carbon credits, viewing them as insufficient compensation for continued pollution by wealthier nations and corporations. They argue for direct compensation and debt relief to address the climate crisis. Sultan Al Jaber, president of COP28, acknowledged the importance of carbon markets but emphasised the need for commonly agreed standards to maintain their integrity.

Dominic Naidoo is an environmental writer for Independent Online (IOL)

Related Topics: